Oleh: Yustin Nur Faizah,S.Tr.Ak.,M.Ak.,Ak

Fraud remains one of the most persistent threats to organizational sustainability worldwide. The Association of Certified Fraud Examiners (ACFE) estimates that organizations lose nearly 5% of their annual revenues to fraudulent activities amounting to trillions of dollars in global losses each year (Rasheed et al., 2023).

What makes fraud particularly complex is not only its severe financial impact but also its dynamic nature, shaped by human psychology, organizational culture, and the evolving global economy. Over the years, scholars have developed various theoretical models to explain why individuals commit fraud. These range from the foundational Fraud Triangle to more advanced frameworks such as the Fraud Star and the Integrity Model, each offering deeper insights into the interplay between opportunity, motivation, and ethical values(Mandal & S., 2024).

The Fraud Triangle Theory, introduced by Donald Cressey in 1953, identifies three essential elements that must be present for fraud to occur: pressure, opportunity, and rationalization. This framework has since become a cornerstone of auditing standards worldwide (Rasheed et al., 2023).

Nevertheless, critics contend that the model oversimplifies the complexity of human behavior. In response, (V. H. Monteverde, 2023) proposed the Fraud Diamond, which adds capability as a fourth element. This refinement acknowledges that even when pressure, opportunity, and rationalization are present, fraud is unlikely to occur unless the perpetrator possesses the necessary skills, authority, or position to exploit organizational weaknesses.

Building on these models, recent studies highlight the central role of integrity in fraud prevention. Scholars argue that preventing fraud requires more than limiting opportunities or monitoring individual capabilities; it also depends on cultivating strong ethical values within organizations. This perspective gave rise to the Fraud Square, also known as the Integrity Model, which positions integrity as a critical counterforce to fraud reducing the likelihood of misconduct even in the presence of pressure or temptation (Saluja et al., 2022).

One of the most ambitious recent developments is the Fraud Star Theory, introduced by (V. H. Monteverde, 2023)This framework expands the traditional models into seven elements: opportunity, rationalization, incentives, capacity, internal scope, external scope, and culture. By integrating insights from behavioral economics, the model recognizes that fraud is shaped not only by economic motives but also by emotions, social norms, and broader cultural contexts (V. Monteverde, 2021) .

A recent empirical study in Indonesia applied the Fraud Star framework to examine asset misappropriation in companies. The findings indicate that while pressure and opportunity remain significant drivers, organizational commitment and robust internal controls are critical in mitigating fraudulent behavior. These results underscore that fraud should not be viewed solely as an individual moral failing but rather as a systemic issue influenced by governance structures and organizational culture.

Taken together, these evolving models illustrate that combating fraud demands a multidimensional approach. While traditional mechanisms such as audits and monitoring remain essential, they are not sufficient on their own. Effective fraud prevention must be reinforced by ethical leadership, a strong organizational value system, and heightened behavioral awareness. Organizations that embed integrity into their culture while simultaneously strengthening internal controls are better positioned to reduce fraud risks and foster long-term trust with stakeholders.

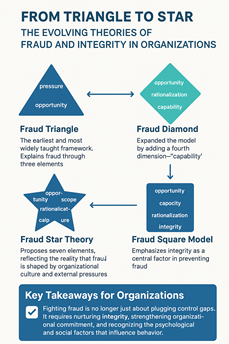

Figure 1. Evolution of Fraud Models

Figure 1. Evolution of Fraud Models illustrates the progressive development of theories aimed at explaining why individuals engage in fraudulent behavior. The framework begins with the Fraud Triangle, which identifies pressure, opportunity, and rationalization as the primary drivers of fraud. This was later refined into the Fraud Diamond through the addition of capability, recognizing that fraud cannot occur unless individuals possess the skills, authority, or position to exploit existing weaknesses. The model further evolved into the Fraud Square, which introduces integrity as a counterbalance, underscoring the importance of ethical values in deterring misconduct. Most recently, the Fraud Star expanded the framework into seven elements opportunity, rationalization, incentives, capacity, internal scope, external scope, and culture thereby capturing the broader behavioral, social, and systemic dimensions that shape fraud in contemporary contexts.

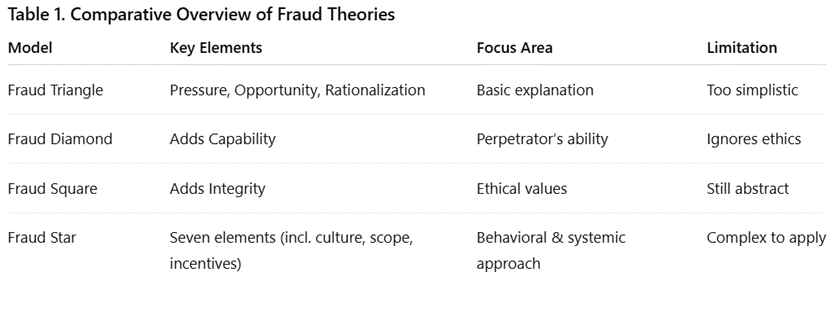

Table 1. Comparative Overview of Fraud Theories summarizes the evolution of fraud models, emphasizing their core elements, focus areas, and limitations. The Fraud Triangle highlights pressure, opportunity, and rationalization, providing a simple yet foundational explanation of fraudulent behavior. The Fraud Diamond builds on this by adding capability, underscoring that personal skills, authority, and access are critical enablers of fraud. The Fraud Square shifts the perspective by incorporating integrity, emphasizing ethical values as a counterforce to misconduct. Most recently, the Fraud Star extends the framework to seven elements including culture, incentives, and scope offering a more holistic view that integrates behavioral, social, and organizational dimensions. While each successive model adds depth and contemporary relevance, the increasing complexity also poses challenges for practical application, particularly in operationalizing the Fraud Star.

Bibliography

Mandal, A., & S., A. (2024). Fathoming fraud: unveiling theories, investigating pathways and combating fraud. Journal of Financial Crime, 31(5), 1106–1125. https://doi.org/10.1108/JFC-06-2023-0153

Monteverde, V. (2021). New Fraud Star Theory and Behavioral Sciences. In Criminology and Post-Mortem Studies – Analyzing Criminal Behaviour and Making Medical Decisions. IntechOpen. https://doi.org/10.5772/intechopen.93455

Monteverde, V. H. (2023). New fraud star theory and behavioural sciences. Journal of Financial Crime, 30(4), 983–998. https://doi.org/10.1108/JFC-06-2020-0114

Rasheed, F., Said, J., & Ismail Khan, N. (2023). EVOLUTION OF FRAUD-RELATED THEORIES: A THEORETICAL REVIEW. Journal of Nusantara Studies (JONUS), 8(3), 322–350. https://doi.org/10.24200/jonus.vol8iss3pp322-350

Saluja, S., Aggarwal, A., & Mittal, A. (2022). Understanding the fraud theories and advancing with integrity model. Journal of Financial Crime, 29(4), 1318–1328. https://doi.org/10.1108/JFC-07-2021-0163